BUSINESS NEWS

GameStop stock frenzy leads to class action suit; key online investor Keith Gill among those sued for $5M-plus

Mina Corpuz

| The Enterprise

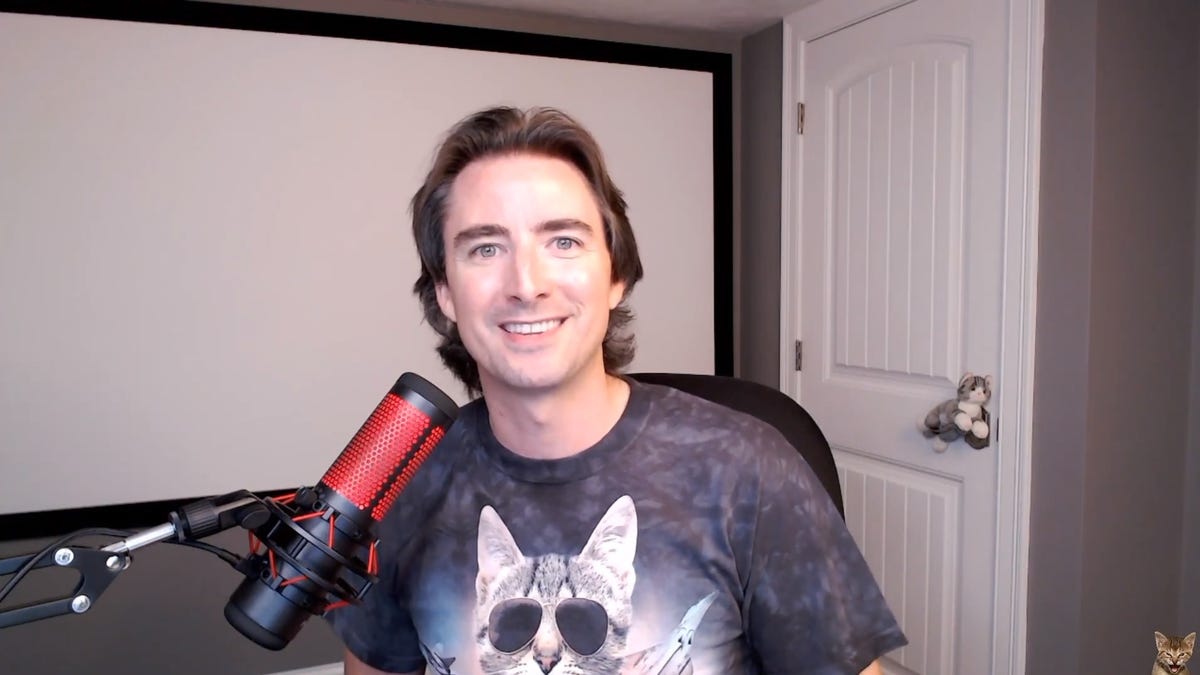

Hedge funds, short selling, short squeeze, explainedFirst GameStop, then silver. Reddit users are putting hedge funds to the test, one short squeeze at a time. Here’s what you need to know.Just the FAQs, USA TODAYBOSTON – Brockton, Massachusetts native Keith Gill, who spent half a year making videos and sharing information about investing, was sued Wednesday in federal district court in Massachusetts for his alleged role in manipulating the stock prices of GameStop.The class action suit, which lists Washington state investor Christian Iovin as the plaintiff, said that its goal is to remedy Gill’s “egregious” conduct and “somewhat restore the integrity of the securities market.” The lawsuit demands a jury trial and asks for $5 million plus in damages. “To orchestrate the manipulation of GameStop stock, Gill created a far-reaching and wildly successful social media campaign in the year leading up to the surge in GameStop shares,” the lawsuit states.Congressional scrutiny of GameStop financial sagaLawmakers are examining whether wild swings GameStop’s stock price of has exposed conflicts in the market’s structure that can hurt unsophisticated investors. Rep. Maxine Waters says “many Americans feel that the system is stacked against them.” (Feb. 18)AP’I am grateful’: Investor testifies before Congress about wild GameStop ride‘I am not a cat’:: Chaotic GameStop hearing provides tense exchanges, humor as lawmakers grill key players”The seeds of an idea Gill proliferated to his now hundreds of thousands of followers –namely, to exponentially drive up the price of GameStop shares – would ultimately germinate into a lucrative windfall for himself, at the expense of Plaintiff and the Class Members.” Gill took on the persona of an amateur by using multiple identities online to promote GameStop, the lawsuit says, referring to his YouTube and Twitter account where he went by “Roaring Kitty” and on Reddit under the username “DeepF***ingValue.” He acted “as a kind of Robin Hood” and characterized securities professionals as villains to motivate amateur traders, the lawsuit says. Gill targeted hedge funds that shorted GameStop as “evil, powerful boys” and advocated for revenge by causing a market frenzy, the plaintiff alleges. In Brockton, Gill is known as a graduate of the city’s high school who was a standout track and field athlete. He went on to attend Stonehill College in Easton where he ran cross-country and indoor and outdoor track and field.Gill holds college records for the 800-meter, 1000-meter and the mile, which he ran in 4:03:43. Gill is the college’s only male runner to get All-America honors for all three of the sports, according to his biography for the college’s Hall of Fame, where he was inducted in 2016. As part of his online persona, members of the Reddit forum r/wallstreetbets saw Gill’s monthly updates about his investments and said they were encouraged to buy shares of their own, the lawsuit says. The suit includes screenshots of comments in the forum to show that Gill further inspired them to hold their shares and manipulate the market. GameStop stock frenzy: You’ve heard about GameStop stocks soaring. Here’s who was behind itRedditors create run: How r/WallStreetBets took down a hedge fund and rode GameStop stock to the moon 🚀As a result of the effort, GameStop’s shares shot up 1,600% to a record of $483 a share and caused huge losses for short sellers and those who bought the stock at higher prices.Gill’s initial $53,000 investment became worth nearly $48 million at the stock’s height. The lawsuit cites Gill’s own videos, Reddit posts and Twitter posts as evidence of his targeting hedge funds and recruiting investors. In reality, Gill wasn’t an amateur, the lawsuit said. He has worked as a professional in finance and investment for more than a decade and was licensed by MML Investor Services and employed by Massachusetts Mutual Life Insurance Co. while he made his YouTube videos and posted on social media. Gill, in written testimony for the U.S. House Committee on Financial Services, said his job was to develop financial education classes that advisors could present to prospective clients. He said he never sold securities or was a financial advisor. MassMutual and MML Investors Services are listed as defendants on the lawsuit. It claims that as Gill’s employers they had legal and regulatory obligations to supervise his conduct and use of social media.Steve Berman, a lawyer who is part of the plaintiff’s legal team and managing partner from the firm Hagens Berman Sobol Shapiro, said in a statement that they are focused on what MML and Massachusetts Mutual knew about Gill’s activities.”By failing to adhere to its own supervision obligation, MML and MassMutual willfully participated in Gill’s manipulative activity and violations… (and) are liable for Gill’s unlawful and manipulative activity,” the lawsuit states.The lawsuit claims that through his actions, Gill violated multiple laws, including the Securities Exchange Act of 1934. The lawsuit’s plaintiff, Iovin, used $200,000 in collateral to sell call options for GameStop on Jan. 26 when the stock was below $100, the lawsuit states. Call options are financial contracts that give the buyer the right to buy a stock, bond or commodity at a specific price within a specific time period.Iovin was “forced to ‘cover’ the options contracts by purchasing back offsetting GameStop options contracts representing Gamestop shares at unwarrantedly and unprecedented inflated prices of $300 and $315 unmoored to the true value of GameStop shares,” causing him to incur “substantial losses,” the lawsuit states.He made the transactions relying on the integrity of the market and didn’t know about what Gill was doing, the lawsuit states. Others from around the country who were similarly affected like Iovin could join the lawsuit class. They needed to have lost money when they purchased GameStop shares, purchased back an option, had an option for the stock called away, bought its shares to cover a short position or had options expire between Jan. 22 and Feb. 2 of this year. The exact number of class members isn’t known, but hundreds of thousands of options were traded during the nearly two-week period, the lawsuit says. “Investors from all walks of life were significantly damaged by the price manipulation incited by Keith Gill and his unsuspecting followers who hung on his every word,” said Berman, of the firm representing Iovin. “Trades and social media of this magnitude does not go unnoticed.”Staff writer Mina Corpuz can be reached by email at mcorpuz@enterprisenews.com and on Twitter: @mlcorpuz.

Source link