BUSINESS NEWS

A financial planner helped me get control of my spending

[ad_1]

When my brother and I were little, we separated any money we made into two Skippy peanut butter jars for savings and spendings. The system worked, for a while.

At 24, after graduating from a master’s program, I wish things were that simple. I’m struggling to figure out how to spend responsibly while juggling more financial obligations.

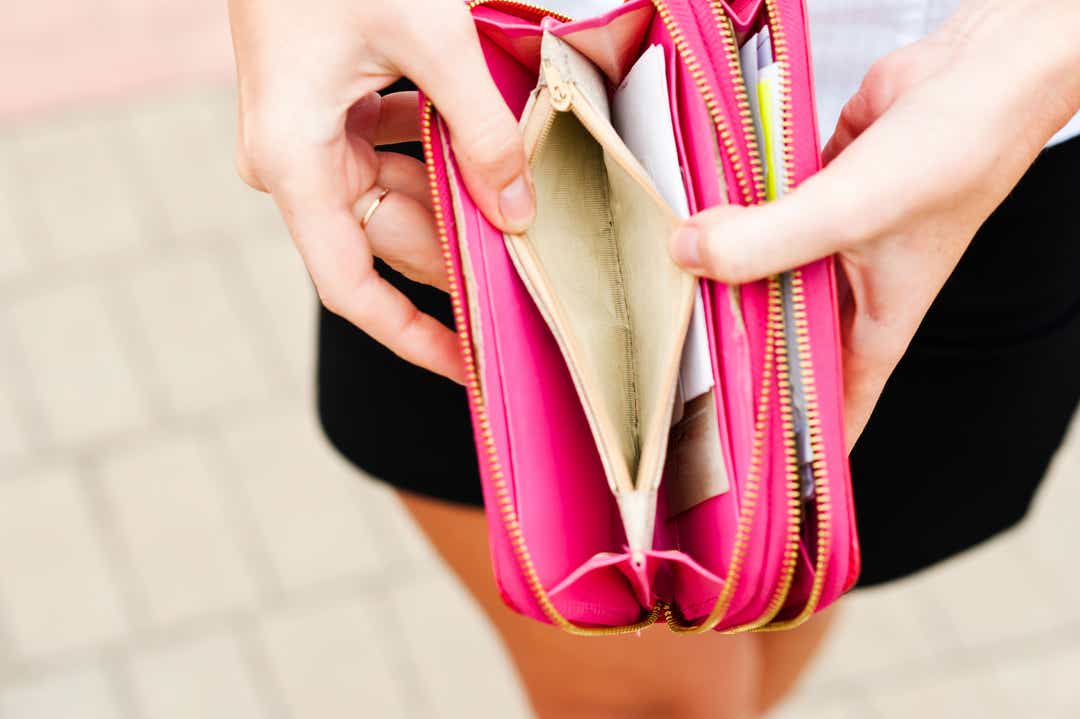

That’s kind of an understatement, actually. Every time I open my banking app, I have to take a really deep breath. It makes me anxious to check the damage from the previous few weeks. When I finally do look, it results in a pained sigh.

Having worked constantly through high school and college, usually taking on at least two jobs per summer, it has been different — and stressful — to not really have any money in the bank during graduate school. Adding to the challenge: I couldn’t work during grad school. As a result, I’ve had to ask my parents for help with rent and sometimes other expenses too.

About me:

- Age: 24.

- Highest education: M.S. in journalism, class of 2019

- Residence: New York City.

- Financial challenges: While my expenses are fairly normal for a millennial girl in New York City, it has been impossible to cover them all. Especially without a job for 10 months of the year while wrapping up grad school. I have had to lean on my parents for financial support, particularly with the cost of New York rent.

- Financial weaknesses: Chipotle, getting nails done, Marshall’s.

- Biggest spending issue I suspected: Food.

I hoped a professional could help me find an adult version of the “peanut butter jar” budgeting method. So I did a two-week experiment with Autumn Campbell, a financial planner.

5 ways to save $50 a week:You don’t have to give up lattes. Here are tips

Your 401(k): Why oil price swings won’t burn America’s economy or your 401(k)

Autumn works at the Planning Center, Inc. Like me, she is a millennial and has confronted challenges similar to the ones I face now: Educational expenses, social expenses, etc.

I went into the experience knowing that my career is in transition and that recently finishing school has created its own set of financial uncertainties — and that’s okay. But it does make this experience with a financial advisor both important and frustrating. The coming months will hopefully bring more stability to my life, along with a new set of challenges, I’m sure.

Through two over-the-phone sessions and a couple of weeks of financial reflection, I found that I didn’t have to give up things I really loved to save money. That realization is helping me get past my financial anxiety and helping me to make productive spending cuts.

The sessions each lasted about an hour. We discussed my background, screen shared to look at my credit card statement and addressed goals for the week.

3 budget mistakes: You’re probably making these

Midyear budget check-in: Why you need one

Session one: Mindset

Much to my surprise, my daily spending habits weren’t my biggest issue, according to my first session with Autumn — but how little time I spent tracking my spending was.

Because I felt anxious and guilty about my daily splurges, I was avoiding checking my credit card statement as much as I should. I had no idea how much money I was actually spending.

Most of my spending could be rationalized, Autumn said. But I could stand to spend less on snacks or coffee. And that once-in-a-while trip to the Urban Outfitter’s sale rack probably wasn’t a necessity either.

The takeaways:

- Check your credit card statement weekly.

- Understand why you are spending. Is it out of necessity, convenience or enjoyment?

It’s about conscious spending, Autumn told me. The more aware you are of what you are spending and why, the less you will spend, likely.

Session two: A hard look

In the week after the first session, I tried to be more mindful of how I was spending my money and to cut back on my biggest expense — convenience food. Then I skipped breakfast on Tuesday.

I really wanted oatmeal from the mini cafe. I caved.

And it happened a few other times during the week. I ran out of coffee at home and stopped at the coffee shop next door on the way to work. I had oatmeal a few more times. I had a friend’s birthday drinks and couldn’t show up empty-handed. I had oatmeal again.

And somewhere in there I really felt like I had to spend money on bottled water rather than just filling my bottle up.

A quick look at the end of the week at my credit card statement and a little math showed I could have saved about $60 just by planning ahead and buying food and coffee at the grocery store instead. If I was able to keep that up for a year, the savings would be in the thousands. That’s a month’s rent — or two.

Here’s the thing: I didn’t really enjoy spending that $60 — it was just pocket change I let slip out of habit. The money I did enjoy spending: about $100 on social activities. Things like bowling and a brunch and dinner out with friends.

When we went over my credit card statement again, Autumn said the social expenses were okay — she suggested budgeting for social outings so that saving money doesn’t deprive you of the things you enjoy most.

The rest of my spending, on the other hand, I could probably cut back. “Some of these things, like snacks, I think you can have a real impact on a daily basis,” she said.

Conscious spending:

- Awareness changes behavior. We make better decisions if something isn’t a habit.

- Habits that already exist can change. I didn’t buy breakfast, lunch, coffee or snacks in week three.

Next step: How to budget

For me, the next step is to budget, Autumn told me after reviewing my spending during session two.

Anything that doesn’t spark joy should come off my budget. Bye to that extra coffee and mini mart snacks — pretty sure my bank account, not to mention my waistline, will thank me for that.

I was more worried about was social activities. It didn’t seem as easy to cut out as my little daily expenses.

“So what I have done personally and I’ve seen done, we save for that expense in our budget,” Autumn said.

Autumn’s tips to cut social costs:

- Eat in on weeknights.

- Have one drink instead of multiple, if you’re drinking.

- Set aside a monthly amount for social expenses. Whatever amount seems appropriate to you. Break it down daily, so if it’s $300 per month it’s about $10 per day. Think about what you are willing to give for a social life.

Budgeting and cutting spending, Autumn said, is about finding a middle ground.

“It’s not how cheap can I be,” she said. “But it’s asking ‘what things could I cut that might not change my lifestyle and happiness that much?'”

Little changes can make a big difference in our actions and in how we feel. They can even lift monetary anxiety.

Follow Morgan Hines on Twitter: @MorganEmHines.

[ad_2]

Source link